Dr. Frankenstein’s Bond Funds

Investors have been worried about rising interest rates for years. That fear has created a bond market fueled by funds designed to protect investors from the any-day-now-you-just-wait interest rate disaster.

Like 1950s-era bomb shelters, these funds are costly protection you don’t need. Ninety-eight percent of all bond money is invested in funds with marginal interest rate risk. Interest rate risk is a phantom menace.

This isn’t just about the handful of inverse ETFs that “short” Treasury bond futures popular with investors speculating on the bond bubble’s pop. It’s about the far larger world of ordinary bond mutual funds using hedge-fund-style techniques to deliver yield without interest rate risk.

In today’s strange income-oriented world, the danger isn’t lurking where you might expect: in interest-rate sensitive, longer-term government and other investment-grade bonds. The risk actually lies in the sort of debt everyone thinks is safe from the most feared bubble in history: low-duration, higher-yield debt.

It’s a monster created by the brilliant Doctors Frankenstein of Wall Street, who have sewn together bits and pieces of the bond and derivatives markets to deliver what everyone wants: yield with limited interest rate risk. In so doing, they’ve created bond funds capable of falling much faster and harder than ordinary bond funds.

The stock market is where you get risky growth. The bond market is where you get safe income. The higher-return stock market has the inconvenient problem of falling about 50% or more every so often. The bond market has the problem of falling when yields go up, potentially wiping out the benefits of any (now often paltry) earned yields. Who wants a 3% bond yield that carries a 30%+ downside if rates rise? Especially when you can expect to lose half of that yield to fund, advisor, and broker fees?

Whenever Wall Street produces a product that claims to reduce the inherent risk of owning (stocks) or lending (bonds) to companies, but keeps the fun properties of growth and yield largely intact, you have the foundation for low returns and high fees.

If enough money follows that strategy (or enough leverage is used,) you could end up with an outright system collapse like we saw in 2007-08, when various types of low-interest-rate-risk debt blew up.

It’s Alive!

Bond investors, like stock investors, make money by putting their money at risk. Bonds have two types of risks associated with them: interest rate risk and credit risk. Usually, the greater the interest rate risk or credit risk a bond has, the higher the yield.

Interest rate risk is the risk investors will lose money in bonds when rates go up. Today’s bond investors are particularly anxious following years of falling rates and repeated warnings that disaster will ensue the moment the Federal Reserve decides this low-rate party is over.

Overblown interest rate-risk phobia has been around since the great inflation of the 1970s that sent rates up to double-digits, slamming bond investors. The fear hangover is similar to the post-1929 stock market, when a 90% drop seemed very likely to stock investors.

This rate fear has grown since the Fed began using ultra-low rates to boost the economy. We noted this situation at play at Vanguard nearly five years ago. It was the foundation of our rationale to own longer-term bonds in our model portfolios and client accounts: the majority is only right a minority of the time.

Credit risk — the risk you’ll lose money in bonds if creditors have trouble repaying the loan, is the other type of bond risk. And surprisingly, today’s bond buyers don’t seem particularly concerned about it. They weren’t in the 2000s before the credit crisis, either.

Unlike interest rate risk, the trouble with credit risk is that it can come into play quickly. Credit risk gets worse during troubled economic times. When the economy is stormy, loans don’t get paid back, so a portfolio of stocks and high-credit-risk bonds can fall about as much as an all-stocks portfolio during a recession — only without the upside potential of equities.

Duration is a measure of interest rate sensitivity. A bond portfolio with a duration of 10 years should fall 10% with a 1% rise in interest rates (and vice-versa). A long-term government bond fund like Vanguard Long-Term Treasury (VUSTX) has a duration of 16.5 and a yield of just 2.81%. That’s a lot of downside for not much upside. Or it’s a lot of upside if you think rates are going to 1%.

Today, if you merged all of the Vanguard bond fund portfolio holdings into one mega-bond fund, you’d have a duration of about 5.3 years and a paltry yield of 1.85% — down from 2.5% when we last wrote about Vanguard’s bond asset distribution (and everyone was saying rates couldn’t go any lower).

If you merged the entire bond fund world (including high-yield junk bond funds) into one portfolio, you’d be looking at about a 4.2 duration (although in practice, this weighted average may be higher than how the superfund would actually behave). For reference, the Lehman Barclays US Aggregate Bond Index has a 5.7 duration. This means investors are taking on less interest rate risk than the total bond market. They’re also assuming more credit risk.

Each dot in the chart above represents a single bond fund. The larger, higher (y-axis) dots are funds with more money in them (I’ve scaled down the size difference between large and small dots, because the big bond funds are so much larger than most bond funds).

The Vanguard Total Bond Index is at the very top, with around $145 billion in assets. The x-axis represents fund duration. The center of the Bond Index bubble is at 5.7 years on the x-axis.

This distribution of assets being heavily weighted to lower-duration bond funds means if the interest rate curve rises rapidly by two full percentage points to a 4.4% 10-year government bond (which is not far off from 1990s levels,) bond investors as a group could lose a whopping 9%, even though the little dots way to the right could be down 20% or more.

Some investors would lose 20%, but most (in the big bubbles) would lose less than 10%. Of course, this loss would be partially offset by yields going up. In other words, if the bond bubble pops, we’re looking at single digit-losses. That’s not much downside for the amount of attention this bond bubble gets.

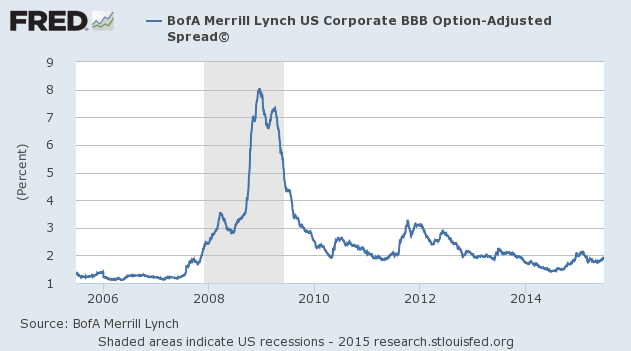

But if the riskier credit side of the bond market cracks, we could see many investors lose 10-40%, just like in 2008, when the spread between safe bonds and risky bonds significantly widened.

You can see this risk spread in the chart below.

What’s interesting about this distribution of bond fund portfolios on the bubble chart is the number of funds with durations of less than 2. In theory, those funds should only fall slightly when rates go up.

How these funds achieve that low duration is where the trouble is brewing.

Many do it the old-fashioned way. They simply own bonds set to mature in just a few years. If you own a bond that matures in three years, but only yields 1%, it doesn’t hurt you that much when rates go up to 5%, because your money’s only tied up in it for just a little while.

But if that bond doesn’t mature for 20 years, a rate increase like that would really sting. A $40 billion dollar fund like the Vanguard Short-Term Bond Index (VBISX) falls into the old-fashioned you-should-buy-bonds-that-mature-in-just-a-few-years category. You can tell, because despite the low fees, the yield’s also low at just 1.09%. Old-fashioned low-duration bond funds yield well below 2% today.

Over the years, Wall Street has invented numerous ways to keep interest rate risk low and yields juicy, including: floating rate bank loans, mortgage bonds, especially adjustable rate mortgage bonds, floating rate asset-backed bonds, shorter-term junk bonds, and increasingly, interest rate hedging strategies. A bond that doesn’t mature for 30 years but has an interest rate that resets annually can have as low a duration as a bond that matures in the near future.

Interest rate hedging, now popular enough to inspire the launch of a dozen ETFs with this strategy in the last few years, requires shorting longer-term treasuries and owning higher-yield bonds. By shorting, say, a 2.5% treasury bond and buying a 5%-yielding riskier bond, you have (theoretically) neutralized the downside of rates rising, but still have a nice net yield left.

It’s a growing list of such ‘hedged’ high-yield (junk) bond funds, including:

- WisdomTree BofA Merrill Lynch High Yield Bond Zero Duration Fund (HYZD)

- ProShares High Yield Interest Rate Hedged ETF (HYHG)

- Market Vectors Treasury-Hedged High Yield Bond ETF (THHY)

- iShares Interest Rate Hedged High Yield Bond ETF (HYGH)

- Deutsche X-trackers High Yield Corporate Bond – Interest Rate Hedged ETF (HYIH)

But this strategy isn’t without risk. You can imagine the danger of going into a credit crisis short treasuries and long junk bonds. Can’t imagine? Vanguard Long-Term Treasury (VUSUX) was up over 22% in 2008, and Vanguard High-Yield Corporate (VWEAX) was DOWN over 21%.

Yikes.

And VWEAX is a conservative junk bond fund.

But this is not really about the handful of new ETFs that are short interest rate risk and long credit risk. This is about seemingly ordinary mutual funds doing the same thing. And who knows how many more secretive hedge funds are doing the same, only also using massive amounts of leverage.

I beheld the wretch — the miserable monster whom I had created.

Mutual fund marketers are no slouches when it comes to selling low-duration funds. If you look closely at our mutual fund universe distribution chart, you’ll see a surprising number of large funds below a zero duration. They achieve this negative duration by shorting, as described above.

A sampling:

| Fund | Assets | Dur. | Yield | Qual. |

|---|---|---|---|---|

| PIMCO Unconstrained Bond I (PFIUX) | $8.5B | -0.7 | 3.36% | BBB |

| Putnam Diversified Income A (PDINX) | $5.9B | -2.0 | 3.97% | BB |

| Scout Unconstrained Bond I (SUBFX) | $1.8B | -1.3 | 0.72% | BBB |

| Putnam Absolute Return 300 A (PTRNX) | $1.0B | -1.17 | 3.60% | BB |

| Janus Global Unconstrained Bond (JUCTX) | $1.5B | -0.55 | 0.50% | BBB |

I guess an ”Unconstrained” bond fund should be able to do what it pleases, but shouldn’t a “diversified income” fund with a diversity of bonds have a positive duration, since that’s what bonds have? When you buy an XYZ Growth Stock fund, you wouldn’t expect a negative beta if the manager decided to net short S&P 500 futures and be long say small cap stocks . A negative duration is a very specific interest rate bet. Putnam Interest Rate Speculation and Income would be a more suitable name. If that bet goes south, don’t come crying to us about how you expected a diversified bond portfolio.

Templeton Global Bond A (TPINX), the world’s third largest bond fund with $58 billion in assets, has a duration of zero. I can’t imagine ordinary 401(k) investors, stuck with few bond fund choices, are expecting such a creation or understand the risks.

Naturally, the fund managers at Templeton (and these other funds) have no issue with credit risk, as we saw in late 2014 when the Ukraine bonds in the portfolio fell 30% in value, hitting the fund for nearly a billion dollars. In 2008, when the credit crisis hit the dramatically widening spread between high-risk and low-risk debt, yields sent Putnam Diversified Income A (PDINX) down by as much as 40% at one point.

If the low duration strategy won’t hurt you, the funds also often partake in an increasingly popular strategy with investors – hedging against currency risk. In an about-face, after a few good years for the greenback, investors stopped panicking about the U.S. dollar and started worrying about Europe’s collapse.

Never mind that the whole reason to own a “Global Bond Fund” is to own bonds and take on some interest rate risk while diversifying out of the U.S. dollar. Why is Templeton trying to turn the big fund into a short-duration, U.S. junk bond fund?

There would be nothing scary about all these low-duration bond funds if most other large bond funds had very long durations, but as the chart shows, most of them are already largely avoiding interest rate risk. They’re protecting investors from a risk hardly anyone’s taking in bonds. There’s more money in funds with portfolios below a 2 duration than above a 7 duration!

Rates are lower now than five years ago, but inflation is somewhat higher. It would have been better to be long duration in 2010 than today. But that doesn’t make today a good time to be heavy on credit risk and short interest rate risk.

While yield and capital gains may now be lower, long and low bond funds almost always deserve a place in a portfolio, especially one with stock market risk. If assets start shifting more out on the yield curve, The Mutual Fund Industrial Complex starts launching funds short on high-risk credit and long treasuries, and investors start moving out on the yield curve, it may be time to reconsider.

Don’t be a moth to the low-D yield flame. You can certainly lose money (and eventually will) in a low-fee, high/long duration and low-credit-risk fund, but investors will almost always lose more money in high-fee, low-duration, high-credit-risk funds.

Importantly, the losses you realize in any number of these clever low-duration vehicles will almost always coincide with major losses in your stock portfolio, which begs the question:

Why bother in the first place?

While there are scenarios where these new Low-D monsters might do well compared to longer-term traditional bond funds with interest rate risk, with yields only around the dividend yields of the stock market (which grow over time) and recession downside risk about the same as the stock market, they don’t compare favorably to stock funds, traditional bond funds, or a mixture of the two.